Page 98 - The Central Motor Vehicles Rules, 1989

P. 98

70 THE CENTRAL MOTOR VEHICLES RULES, 1989 RULE 51B

1

[51A. Concession in motor vehicle tax

51A

In case the vehicle is registered against submission of “Certificate of Deposit”, the

concession in the motor vehicle tax shall be,—

(i) upto twenty-five per cent., in case of non-transport vehicles; and

(ii) upto fifteen per cent., in case of transport vehicles:

PROVIDED that this concession shall be available upto eight years, in case of

transport vehicles, and upto fifteen years, in case of non-transport vehicles and there

shall be no concession in the motor vehicle tax in case of transport vehicles, after eight

years, and, in case of non-transport vehicles, after fifteen years.

Explanation 1 : For the purposes of this rule, these periods shall be reckoned from

the date of first registration in both cases.

Explanation 2 : For the purposes of these rules, the expression "Certificate of

Deposit" shall have the same meaning as assigned to it in clause (c) of sub-rule (1) of

rule 3 of the Motor Vehicles (Registration and Functions of Vehicle Scrapping Facility)

Rules, 2021.]

2

[51B. Principle for motor vehicle tax

(1) In case of fully built non-transport vehicles, the motor vehicle tax shall be

51B

calculated electronically through the portal on the basis of invoice price excluding Goods

and Services Tax (GST).

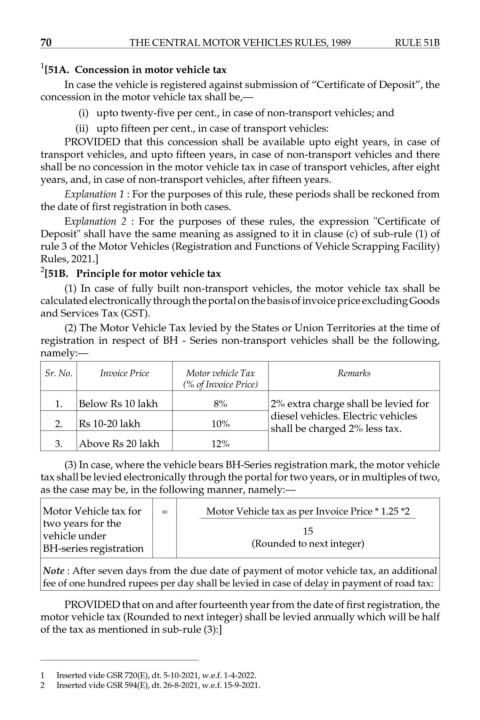

(2) The Motor Vehicle Tax levied by the States or Union Territories at the time of

registration in respect of BH - Series non-transport vehicles shall be the following,

namely:—

Sr. No. Invoice Price Motor vehicle Tax Remarks

(% of Invoice Price)

1. Below Rs 10 lakh 8% 2% extra charge shall be levied for

diesel vehicles. Electric vehicles

2. Rs 10-20 lakh 10%

shall be charged 2% less tax.

3. Above Rs 20 lakh 12%

(3) In case, where the vehicle bears BH-Series registration mark, the motor vehicle

tax shall be levied electronically through the portal for two years, or in multiples of two,

as the case may be, in the following manner, namely:—

Motor Vehicle tax for = Motor Vehicle tax as per Invoice Price * 1.25 *2

two years for the

15

vehicle under

BH-series registration (Rounded to next integer)

Note : After seven days from the due date of payment of motor vehicle tax, an additional

fee of one hundred rupees per day shall be levied in case of delay in payment of road tax:

PROVIDED that on and after fourteenth year from the date of first registration, the

motor vehicle tax (Rounded to next integer) shall be levied annually which will be half

of the tax as mentioned in sub-rule (3):]

1 Inserted vide GSR 720(E), dt. 5-10-2021, w.e.f. 1-4-2022.

2 Inserted vide GSR 594(E), dt. 26-8-2021, w.e.f. 15-9-2021.