Page 787 - The Central Motor Vehicles Rules, 1989

P. 787

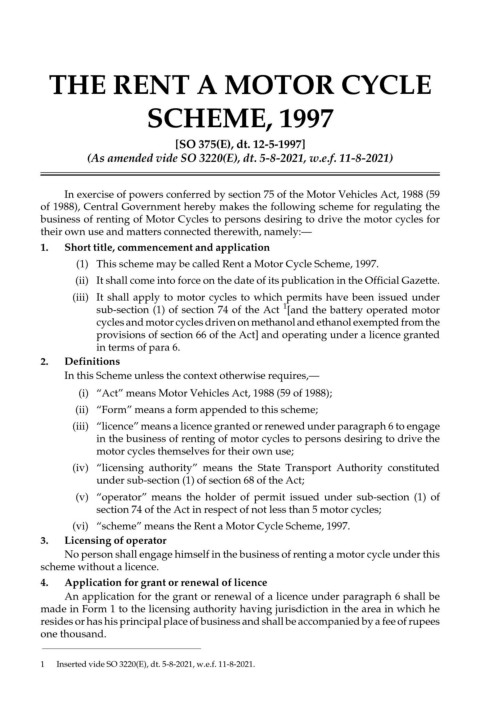

THE RENT A MOTOR CYCLE

SCHEME, 1997

[SO 375(E), dt. 12-5-1997]

(As amended vide SO 3220(E), dt. 5-8-2021, w.e.f. 11-8-2021)

In exercise of powers conferred by section 75 of the Motor Vehicles Act, 1988 (59

THE RENT A MOTOR CYCLE SCHEME, 1997

of 1988), Central Government hereby makes the following scheme for regulating the

business of renting of Motor Cycles to persons desiring to drive the motor cycles for

their own use and matters connected therewith, namely:—

1. Short title, commencement and application

(1) This scheme may be called Rent a Motor Cycle Scheme, 1997.

(ii) It shall come into force on the date of its publication in the Official Gazette.

(iii) It shall apply to motor cycles to which permits have been issued under

1

sub-section (1) of section 74 of the Act [and the battery operated motor

cycles and motor cycles driven on methanol and ethanol exempted from the

provisions of section 66 of the Act] and operating under a licence granted

in terms of para 6.

2. Definitions

In this Scheme unless the context otherwise requires,—

(i) “Act” means Motor Vehicles Act, 1988 (59 of 1988);

(ii) “Form” means a form appended to this scheme;

(iii) “licence” means a licence granted or renewed under paragraph 6 to engage

in the business of renting of motor cycles to persons desiring to drive the

motor cycles themselves for their own use;

(iv) “licensing authority” means the State Transport Authority constituted

under sub-section (1) of section 68 of the Act;

(v) “operator” means the holder of permit issued under sub-section (1) of

section 74 of the Act in respect of not less than 5 motor cycles;

(vi) “scheme” means the Rent a Motor Cycle Scheme, 1997.

3. Licensing of operator

No person shall engage himself in the business of renting a motor cycle under this

scheme without a licence.

4. Application for grant or renewal of licence

An application for the grant or renewal of a licence under paragraph 6 shall be

made in Form 1 to the licensing authority having jurisdiction in the area in which he

resides or has his principal place of business and shall be accompanied by a fee of rupees

one thousand.

1 Inserted vide SO 3220(E), dt. 5-8-2021, w.e.f. 11-8-2021.